By all accounts, electric vehicles are the future. Right now, EV’s comprise a small percentage of the automotive marketplace. A new study from the Ecology Center in Ann Arbor shows the electric vehicles owners are paying far more in taxes and fees and that can serve as a disincentive to purchase. The center’s Charles Griffith joined WEMU’s David Fair for this week’s "Issues of the Environment" to share the study’s findings and discuss the need to create policy that will create tax parity for EV vehicles.

Overview

- Michigan’s 2015 transportation funding legislation sought to address the state’s road funding woes by raising fuel taxes, vehicle registration fees, and making transfers from the general fund.

- In January 2020, Ann Arbor’s Ecology Center released a new study that shows EVs are paying significantly more fees than comparable gas-powered vehicles. For plug-in electric vehicle drivers, the law also introduced new annual surcharges on registration fees at $30 for plug-in hybrid electric vehicles (PHEVs) and $100 for all-electric EVs. An additional fee is charged to these drivers based on an escalating formula tied to each increase of one cent in the state gas tax above its original $0.19 level. As of 2017, this means that PHEV drivers pay an additional fee of $47.50 and EV drivers pay an additional $135. When combined with the value based (ad valorem) fee that every owner pays when registering their vehicles, plug-in vehicle drivers are now paying between $300 and $390 in up-front fees.

- The result of these new fees is that PHEVs and EVs pay significantly more in annual transportation-related taxes than comparable gasoline vehicles.

- One reason the fees on electric vehicles are so much higher is that they are based on the fuel taxes that “average” gas-powered vehicles--like the larger and heavier Ford F-150 pickup truck, rated at 25 mpg--pay on an annual basis. However, today’s plug-in vehicles are more similar in size and efficiency to gas-powered cars like the Ford Fusion Hybrid or Honda Insight, which achieve closer to 50 mpg. The other reason EV fees are higher is because plug-in vehicles already pay higher ad valorem registration fees (and sales taxes), due to their higher purchase cost.

- “Paying Their Fair Share” proposes several options for legislators to improve the current situation. One straightforward stopgap measure would be to lower PHEV and EV fees to more equitable rates, or at least to freeze them at their current rates. A better, more equitable approach in the short or medium-term would be to replace a single fixed EV surcharge with differentiated fees based on the total road funding fees and taxes that comparable gasoline vehicles pay.

- Longer-term, additional solutions will still need to be explored to address anticipated increases in vehicle fuel-efficiency overall, as well as reflect the actual mileage that plug-in vehicles travel each year.

- Not everyone agrees that EV owners are being overtaxed, and some argue that because society bears the cost of building the associated EV charging infrastructure, the poor who cannot afford to drive an EV are subsidizing those who can afford one.

- Charles Griffith, Climate and Energy Program Director for the Ecology Center in Ann Arbor, says an equitable solution in the short term taxes EVs more closely with similar sized gas vehicles, and a long-term ought to incentive clean vehicle ownership rather than penalize it.

Executive Summary on Ecology Center Finding on Disproportionate EV Fees

Michigan’s 2015 transportation funding legislation sought to address the state’s road funding woes by raising fuel taxes, vehicle registration fees, and making transfers from the general fund. For plug-in electric vehicle drivers, the law also introduced new annual surcharges on registration fees at $30 for plug-in hybrid electric vehicles (PHEVs) and $100 for all-electric EVs. An additional fee is charged to these drivers based on an escalating formula tied to each increase of one cent in the state gas tax above its original $0.19 level. As of 2017, this means that PHEV drivers pay an additional fee of $47.50 and EV drivers pay an additional $135. When combined with the value based (ad valorem) fee that every owner pays when registering their vehicles, plug-in vehicle drivers are now paying between $300 and $390 in up-front fees.

The result of these new fees is that PHEVs and EVs pay significantly more in annual transportation-related taxes than comparable gasoline vehicles. As shown in Figures 1 and 2, the most popular plug-in hybrid models pay between $20 and $70 more, while full-electric models pay between $90 and $160 more than their internal combustion engine (ICE) counterparts. These fees are as much as 30% higher for PHEVs and 67% higher for EVs than comparable ICE vehicles under today’s transportation taxes. This disparity will continue to grow if gas taxes are increased beyond current rates.

One reason the fees on electric vehicles are so much higher is that they are based on the fuel taxes that “average” gas-powered vehicles--like the larger and heavier Ford F-150 pickup truck, rated at 25 mpg--pay on an annual basis. However, today’s plug-in vehicles are more similar in size and efficiency to gas-powered cars like the Ford Fusion Hybrid or Honda Insight, which achieve closer to 50 mpg. The other reason EV fees are higher is because plug-in vehicles already pay higher ad valorem registration fees (and sales taxes), due to their higher purchase cost. In this sense, EV owners are being asked to pay twice: once for the higher value of the vehicle compared to gasoline models, and once again for not paying gasoline taxes. A more equitable approach would be for plug-in vehicle fees to be based on the total road funding fees and taxes that comparable gasoline vehicles pay.

PROPOSED NEW EV FEE STRUCTURE

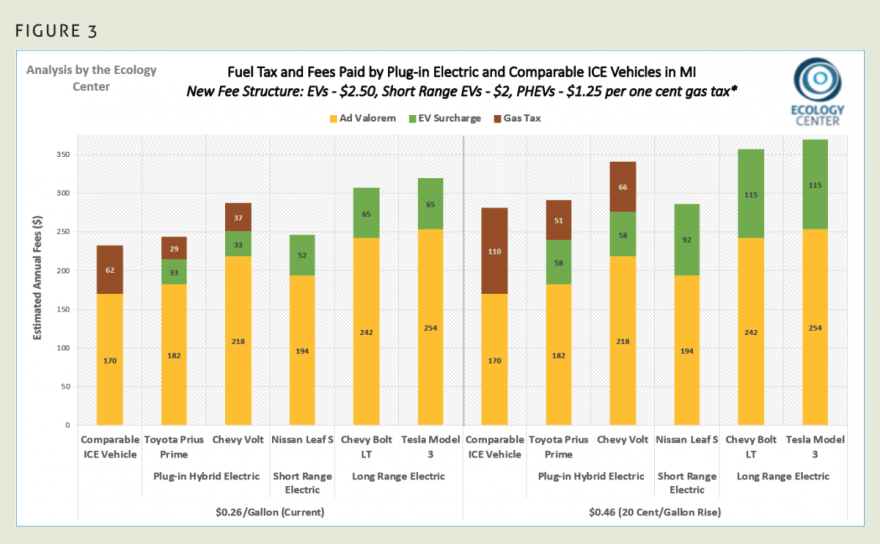

Plug-in electric vehicles should pay their fair share of transportation system costs, meaning that the additional fees they pay should be lowered to a level comparable with what efficient ICE vehicles pay. The Ecology Center’s analysis shown in Figure 3 illustrates what these fees would look like if fixed annual surcharges were eliminated and replaced with escalating plug-in fees set at half the current rate. This new structure would mean drivers of plug-in vehicles would pay an additional fee on each cent in state gas tax of $1.25 for PHEVs, $2 for short driving range EVs, and $2.50 for long range full electric vehicles. While other potential solutions could be applied, this approach would bring ICE taxes and fees for each kind of plug-in vehicle much closer to parity, both today and under any future gas tax rate.

“Paying Their Fair Share”: Getting EV Fees Right in Michigan’s Road Funding Debate

As Michigan’s lawmakers debate the best path forward for our transportation system, we should seek real and sustainable funding solutions that don’t unfairly penalize this growing market. The plug-in vehicle fees instituted in the 2015 legislation are too high relative to their fair share of system costs, and will diverge even further under higher gas tax rates while providing only a tiny fraction of the state’s needed transportation revenue. Instead of further disincentivizing the adoption of this clean transportation technology, lawmakers should revise the EV fee rates in the 2015 legislation to bring them toward parity with more comparable, efficient gas-powered vehicles.

Longer-term, additional solutions will need to be explored to address anticipated increases in vehicle fuel-efficiency overall, as well as reflect the actual mileage that plug-in vehicles travel each year. We suggest applying several key principles to guide future decisions that allow the state to maintain sustainable revenues for maintaining and improving the state’s roads and bridges, promote less polluting technologies, and treat all vehicle drivers fairly at the same time.

As Michigan’s infamous pothole season is set to begin, state leaders will once again be debating potential funding options to address road conditions that continue to rank among the worst in the country. What’s less clear is whether those road funding solutions will continue to penalize those behind the wheel of electric vehicles.

The Ecology Center has released a new report offering original research and policy recommendations for a road funding model that promotes--rather than hinders--a clean transportation shift benefitting the health of Michigan’s environment, people, and economy. “Paying Their Fair Share: The Problem with Michigan’s EV Road Funding Fees and Potential Solutions” addresses an overlooked equity issue with the current model.

The Ecology Center’s research shows that battery electric and plug-in hybrid vehicle owners are charged more in taxes and fees than owners of comparable gasoline-powered cars and trucks. A lot more. Plug-in vehicle drivers currently pay between $300 and $390 in up-front vehicle registration fees each year, about twice as much as comparable vehicles. Since these vehicles represent fewer than 1% of cars and trucks on the road today, the disproportionately high fees accomplish very little to improve our state’s roads and bridges. However, the fees do make cleaner cars less appealing and accessible for cost-conscious consumers.

Even when including the gas taxes that comparable gasoline vehicles pay, total fees and taxes paid are as much as 67% higher for electric vehicles (EVs) and 30% higher for plug-in hybrid electric vehicles (PHEV) than their internal combustion counterparts. A typical EV driver currently pays $90-$160 more each year than the driver of a comparable gasoline-powered car or truck, and someone with a PHEV pays $20-$70 more. And because the EV surcharge is tethered to the gas tax, these disparities will grow even wider if gas taxes are increased without a change to the current surcharge formula.

Michigan’s road funding comes from a combination of gas taxes and vehicle registration fees, along with $600 million from the general fund. Because our fuel taxes weren’t indexed to inflation and because all vehicles have gotten more fuel efficient, Michigan has fallen behind and doesn’t collect enough revenue to keep its roads maintained.

While compromise legislation raised gas taxes and registration fees across the board in 2015, it also added annual surcharges for plug-in electric and hybrid vehicles--intended to make up for lost gas tax revenue. Unfortunately, the 2015 adjustments weren’t enough to solve long-term funding shortfalls, and they imposed a calculation formula that overburdens EV drivers.

Electric vehicles should pay their fair share of transportation system costs, but this means that the additional fees they pay should be lowered to a level comparable with what efficient internal combustion engine vehicles pay, rather than the fuel taxes and wear-and-tear expectations of “average” gas-powered vehicles. Currently, for example, EV fees are assessed based on the amount of gas consumed by a 25 mpg vehicle, such as an Ford F-150 pickup truck. Most EVs, however, are more similar in size and efficiency to a Ford Fusion or Honda Insight averaging closer to 50 mpg.

Another problem is that EV owners are essentially being asked to pay twice: first, for the higher registration fees that they already pay and second, for the electric vehicle surcharge for not paying gas taxes. Because plug-in vehicle owners pay more for their cars up front, they already pay higher sales taxes and registration fees, even before the electric vehicle registration surcharge. These higher registration fees largely make up for any lost gasoline tax revenues, even before the surcharge.

“Exorbitantly high fees on the small number of EVs on state roads are not a real solution to Michigan's transportation funding problems,” says report co-author James Vansteel. The fees primarily serve as an added cost barrier to electric vehicle adoption. And it’s a hindrance affecting many more people than potential EV buyers, given the role EVs will inevitably play in mitigating climate change and shaping the future of Michigan’s automotive industry. “As a state we should be considering ways to support this emerging EV market rather than penalizing it, while exploring more innovative and sustainable ways to maintain our roads and bridges," said Vansteel.

Ecology Center Climate and Energy Director and report co-author Charles Griffith also emphasizes the economic significance of EV fees: “Given Michigan’s stake in the future of the auto industry, which is increasingly electric, it is critical that our state take a more nuanced and fair approach to levying fees on these vehicles,” said Griffith. “If we want the rest of the world to buy the advanced technology vehicles that our auto sector is producing, we need to guide the way in developing the advanced vehicle policies that will help to accelerate their adoption.”

“Paying Their Fair Share” proposes several options for legislators to improve the current situation. One straightforward stopgap measure would be to lower PHEV and EV fees to more equitable rates, or at least to freeze them at their current rates. A better, more equitable approach in the short or medium-term would be to replace a single fixed EV surcharge with differentiated fees based on the total road funding fees and taxes that comparable gasoline vehicles pay.

Longer-term, additional solutions will still need to be explored to address anticipated increases in vehicle fuel-efficiency overall, as well as reflect the actual mileage that plug-in vehicles travel each year. “Paying Their Fair Share” suggests applying several key principles to future decisions: revenue sufficiency and sustainability, taxation paid proportionally by system beneficiaries and cost-causers, social equity, and incentivization of cleaner and more efficient technologies.

“We know that it’s possible for Michigan to simultaneously generate sustainable revenue for maintaining and improving the state’s roads and bridges, promote less polluting technologies, and treat all vehicle drivers fairly at the same time,” says Griffith. “Now is not the time to penalize those who are buying the next-generation of cars and trucks that our state’s iconic industry is now literally banking its future on.”

Electric Vehicles are hip and happening. Media reports gush over auto manufacturer plans to transition their fleets to EV production in an alleged response to growing grassroots and public demand. When asked, hybrid and battery electric vehicle advocates and owners proudly state their love for their vehicles. But when you dig into the details, you find more to the story than just growing consumer demand.

There is no doubt that a certain portion of EV owners are simply dedicated to the technology and willingly pay a hefty price to own one. But media reports point to government policy as the “linchpin for EV adoption,” including mandates for EV use, forcing electricity consumers to pay for charging infrastructure and continued subsidies for EV manufacturers and buyers.

One problem with those policies is that they tend to benefit big auto manufacturers and relatively well-to-do EV buyers, but do so at the expense of the taxpayer. A 2017 CarMax/CleanTechnica survey clarifies the demographics of the average EV owner: 65 percent are over 40, over 70 percent are college educated, and almost 70 percent make over $75,000 per year. One other interesting statistic appears when EV owners are asked how they travel when they plan to go beyond the range of their vehicle’s batteries; 42 percent noted they “use a second car.” Ostensibly their second vehicle is fossil-fueled and, therefore, not similarly range-limited.

A recent study by TrueCar.com confirmed these demographics, reporting that the average Ford Focus Electric owner was 43 and had an annual household income of $199,000. Fiat 500e owners had an average age of 45 and household income of $145,000. John Krafcik, president of TrueCar.com noted that “[t]hese are really affluent folks” and explained that they are attracted to EVs in large part because of the deals, subsidies and rebates offered to EV buyers. Krafcik noted that looking for bargains was “in their psyche.”

And the bargains appear to be rolling in for this group because a key requirement to the broad acceptance of EVs is the dire need for far more charging infrastructure. A recent Bridge op-ed, with a headline that bluntly states Michigan’s elected officials “should boost electric vehicle markets,” confirms this reality. The authors write: “[B]oth major utility companies here in Michigan, DTE Energy and Consumers Energy, have submitted plans to the Michigan Public Service Commission for charging networks, which would increase the number of charging stations and ensure a rate structure is in place to accommodate EV drivers.”

But accommodating EV drivers means non-EV-owning people need to cover the cost of installing chargers for “really affluent folks” who want their Tesla Model 3s and Nissan Leafs topped up when they’re out and about town. To help make that a reality, the Michigan Public Service Commission, the state government authority that oversees electric utilities, approved a July 2018 rate increase for all DTE customers. That increase will force Michigan residents to pay for the $13 million the utility plans to spend on EV charging stations. In January last year, the MPSC also approved a Consumers Energy rate increase that, in part, covers the costs of a $10 million “PowerMIDrive” program to “support the growing [EV] market in Michigan.”

Among the “support” offered was a $500 rebate for each EV purchased and $5,000 rebates to install chargers in public areas. Up to $70,000 rebates would be available for installing a DC Fast Charger, which is valued for its ability to quickly charge EVs in higher traffic areas. The Commission also allowed Consumers Energy to “recover program costs over five years through a deferred accounting mechanism,” regulator- and utility-speak for “add a surcharge to everyone’s utility bill.”

Of course no one is suggesting that research and development of hybrid and battery EV technologies should cease or be held back. But many of us are quite comfortable suggesting that the regulations, subsidies and mandates forcing all Michigan residents to foot the bill for EVs are fundamentally unfair.

EV owners are willing to pay a premium to purchase their cars and they enjoy the benefits associated with owning them. It is only reasonable that they should pay the other costs associated with them — like installing charging infrastructure — as well. After all, the statistics show, pretty convincingly, that if anyone is able to cover those additional costs, it is EV owners themselves.

Non-commercial, fact based reporting is made possible by your financial support. Make your donation to WEMU today to keep your community NPR station thriving.

Like 89.1 WEMU on Facebook and follow us on Twitter

— David Fair is the WEMU News Director and host of Morning Edition on WEMU. You can contact David at 734.487.3363, on twitter @DavidFairWEMU, or email him at dfair@emich.edu